Introduction – The Price of Accountability

Tiger conservation has been living on borrowed generosity. For years, NGOs, governments, and philanthropists have treated survival as a charity project—dependent on donations, campaigns, and conferences. But goodwill cannot finance an extinction crisis driven by trillion-dollar industries. Palm oil, mining, timber, construction, and global consumer brands have extracted and advertised their way through tiger habitats, leaving behind an unpaid debt that no fundraiser can cover.

At the 2010 Global Tiger Initiative in St. Petersburg, world leaders promised recovery through collaboration. Twelve years later, most of that promise has evaporated into press releases. The 2024 Sustainable Finance for Tiger Landscapes Conference in Bhutan revived the optimism, daring to announce a target of one billion US dollars. Yet that figure, compared with global profit chains, is symbolic—less than the annual marketing budget of a single multinational that sells speed or strength behind a tiger logo.

Real progress now demands industry payments: structured, binding financial contributions from companies that profited from destruction or symbolism. If each corporate user of tiger imagery contributed just one percent of turnover—not profit—the result would exceed ten billion US dollars annually. Add the industry payments owed by extractive sectors for habitat loss, and that sum could double. Conservation no longer needs sympathy; it needs enforcement. The future of the tiger will depend not on donors, but on debtors—those who took the most, finally giving back what they owe.

The Failure of the Donor Economy

Every decade begins with another promise to save the tiger, and every promise ends the same way—with headlines, pledges, and an empty balance sheet. The 2010 Global Tiger Initiative in St. Petersburg declared that political will and philanthropy would double tiger numbers by 2022. The goal was noble; the financing was naïve. Pledges evaporated faster than forests, and donor fatigue set in before fieldwork began. Twelve years later, the 2024 Sustainable Finance for Tiger Landscapes Conference in Bhutan repeated the ritual. It had courage, ambition, and the right moral tone. It even dared to set a target of one billion US dollars. But against the scale of destruction, that figure is a polite fraction of need.

The failure is structural. Donor money depends on emotion; extraction depends on economy. Philanthropy builds awareness, not enforcement. While conservation campaigns raise millions, the industries responsible earn trillions. Only industry payments can close that gap—binding contributions from companies that built fortunes on tiger imagery or destroyed its habitat. One percent of annual turnover from these sectors would raise ten billion dollars each year, enough to secure every major corridor in Asia. Add construction, palm oil, and mining industry payments, and at least another ten billion US$ could follow. The math exposes the truth: donors sustain narratives; industries sustain the damage. It is time their balance sheets carried both sides of that story.

The True Cost of Habitat Theft

Every forest cleared for palm oil, mining, or infrastructure carries a hidden invoice that has never been paid. When a company fells trees, drains wetlands, or cuts corridors for roads, it does not just remove vegetation—it erases water systems, soil integrity, and food chains. These losses are treated as externalities, invisible to balance sheets. Industry payments are how they return to visibility. They measure the ecological debt of progress in currency the world understands.

To rebuild one square kilometer of viable tiger habitat can cost over a million US dollars. That includes restoring vegetation, reviving prey populations, and maintaining anti-poaching patrols. By conservative estimates, more than 30,000 square kilometers of core tiger terrain have been lost to commercial activity since 2000. The bill, if fully calculated, runs into tens of billions. Donor funding can never fill that gap, because donations come from empathy; industry payments come from obligation.

When companies are forced to price destruction, their behavior changes. Habitat protection becomes cheaper than habitat loss. Governments should embed industry payments into licensing, taxation, and trade agreements, ensuring that every extraction site, plantation, and highway contributes to the land it fragments. This is not a moral appeal; it is economic hygiene. The real theft is not just of trees or space—it is of responsibility. The day companies start paying for the ground they take will be the day conservation moves from charity to justice.

Greenwashing and the Myth of Corporate Virtue

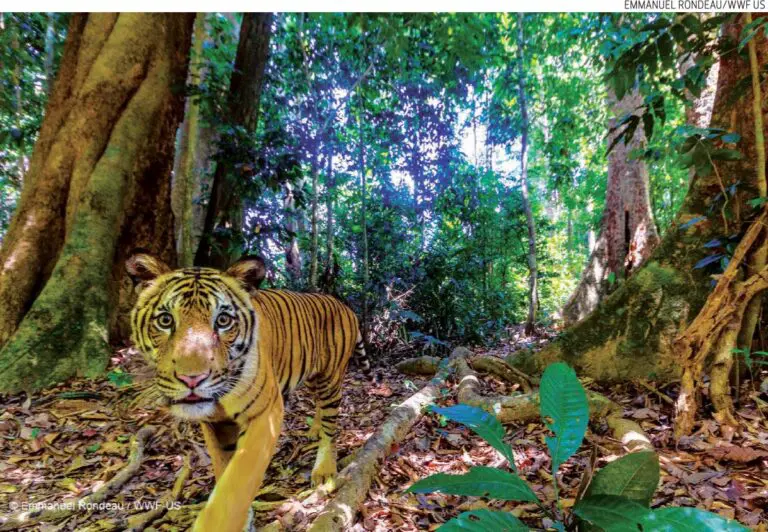

For decades, corporations have perfected the art of looking responsible while doing harm. Annual reports glow with images of trees, slogans of renewal, and smiling mascots borrowed from the wild. The tiger is one of the most exploited. Its face sells fuel, clothes, luxury watches, and financial products—all branded as strong, fearless, and pure. The same companies that use its image invest almost nothing in its survival. Their pledges of sustainability are marketing lines, not moral lines. Industry payments would end that illusion by converting performance into proof.

Corporate social responsibility programs are designed to protect reputations, not ecosystems. A few scholarships here, a handful of saplings there—none of it matches the destruction these brands endorse through supply chains or advertising. The current system rewards appearance, not action. Industry payments would reverse that logic. They would make conservation a fixed cost of doing business, not a seasonal donation. If a company profits from tiger symbolism or raw materials from tiger range states, it must pay into the landscapes it exploits.

Media applause for green campaigns sustains the myth of virtue. It tells consumers that buying the right brand is enough, that guilt can be outsourced through marketing. Industry payments expose this deceit. They force accountability onto balance sheets, where sentiment cannot hide. Real responsibility begins when compliance replaces charity and when a tiger’s worth is measured not in likes or logos, but in hectares restored to the wild.

The Economics of Responsibility

For too long, conservation has been spoken of as cost rather than investment. Governments and corporations treat it as a burden on progress, a noble expense with no return. Yet the tiger’s landscape is an economy in itself—rivers, forests, and soil systems that feed millions. When those are destroyed, entire regions pay the price through floods, droughts, and declining yields. Industry payments correct that blindness by turning environmental value into measurable responsibility. They are not punishment; they are maintenance fees for the planet’s operating system.

Traditional philanthropy runs on moods and markets. When crises fade from headlines, so does funding. Industry payments, by contrast, are structured, recurring, and scalable. They can be built into corporate tax systems, brand licensing, or commodity pricing, ensuring that those who take from nature also sustain it. A single percentage of annual turnover across industries that depend on tiger landscapes—agriculture, mining, construction, and manufacturing—could secure every known corridor and fund anti-poaching for decades.

Economists already model carbon costs; biodiversity deserves the same treatment. Industry payments internalize what was once external, transforming degradation into debt service. Each contribution becomes an investment in stability—of ecosystems, economies, and reputations. The tiger’s survival is not charity; it is insurance. Every hectare preserved reduces the risk of disaster, litigation, and social unrest. Paying for that stability is not an act of generosity—it’s simply sound accounting.

Governments, Complicity, and Political Will

Governments hold the power to make industry payments the law, yet most still treat conservation as a side project. Ministries of environment are underfunded while departments of commerce expand. Licensing boards approve new roads, mines, and factories with impact statements designed to justify, not to prevent. When tiger habitats disappear under legal permits, destruction becomes official policy. The same governments that sign conservation pledges often subsidize the industries causing the damage. Without legislation, industry payments remain voluntary gestures lost in annual reports.

Political leaders claim that enforcing payments would deter investment. The opposite is true. Predictable environmental obligations create certainty for responsible companies and expose those relying on exploitation. Industry payments are not anti-development—they are development done correctly. They would transform the approval process from a negotiation into a contract: if you profit from nature, you must repair what you alter. Nations already charge for emissions and water use; biodiversity loss deserves the same rigor.

The absence of enforcement is not ignorance—it is strategy. Many officials benefit from industries that thrive on short-term extraction. Until transparency laws and independent audits track where every environmental dollar comes from and goes, corruption will remain the quiet partner of extinction. Industry payments backed by legal mandate and global oversight would dismantle that alliance. The world does not lack money to save tigers—it lacks governments willing to make the powerful pay.

Media, Pressure, and Public Perception

The global media landscape has the power to turn silence into outrage—but in conservation, it often chooses comfort over confrontation. Headlines celebrate new tiger cubs or donor pledges, rarely tracing the industries responsible for habitat loss. The same corporations funding glossy awareness campaigns also buy advertising space that shapes editorial tone. Industry payments would only become mainstream once the media learns to expose, not applaud. Every campaign featuring a tiger should be questioned: how much of its profit flows back into the landscapes that image was borrowed from?

Journalists and filmmakers have a duty to connect economics with ecology. The destruction of tiger forests is not a distant tragedy; it is a human enterprise with invoices, shareholders, and marketing budgets. Investigations into supply chains, greenwashing, and unpaid ecological debts could redefine public understanding. Industry payments should be reported like carbon pricing or corporate taxes—figures that show who contributes and who evades.

Public opinion remains the most underused force in conservation. When consumers realize that the tiger on a logo represents an unpaid debt, perception shifts from admiration to accountability. Media can accelerate that shift by naming beneficiaries and calculating what they owe. The day newspapers publish the first global industry payments index, companies will compete not in rhetoric but in restitution. The story of conservation will finally read like what it is—a ledger of who took, who gave back, and who still refuses to pay.

Building a Global Framework

The tiger’s survival requires more than good intentions; it requires architecture. Industry payments will only work when tied to a global, transparent system that converts moral pressure into legal obligation. The precedent already exists. Nations cooperate on carbon pricing, fisheries management, and deforestation monitoring. A similar model could govern biodiversity finance, with independent oversight panels and traceable ledgers. Each country that hosts tiger habitat would register its industries, assess ecological damage, and collect mandatory payments directed into verified restoration projects. No donations, no intermediaries—just direct accountability.

A global framework for industry payments could operate under the UN Environment Programme or a consortium of tiger-range states. Payments would be indexed to turnover, not profit, preventing corporations from hiding behind accounting tricks. Auditors would ensure funds reach landscapes, not conference rooms. Digital transparency could make every hectare restored visible to the public.

The greatest advantage of such a system is scale. A one-percent annual turnover levy across industries that profit from tiger symbolism or land use could generate more than ten billion US dollars per year.

Add parallel industry payments from mining, road construction, and real estate, and the total doubles. This is not theoretical—it is simple arithmetic. A connected world already tracks global trade and emissions; tracking ecological debt is the next frontier. The tiger’s forests deserve the same financial infrastructure we give to oil and gold.

Turning Corporate Power Into Ecological Capital

Corporations have always known how to shape the world—they just never had to pay for it. The same logistical precision that builds pipelines, markets smartphones, and ships palm oil could just as easily rebuild forests if directed through obligation instead of choice. Industry payments harness that machinery, turning corporate power from destructive efficiency into restorative momentum. Conservationists talk of innovation, but the private sector already owns the most efficient systems for funding, tracking, and delivery. It simply lacks incentive.

By tying environmental costs to turnover, governments can transform boardroom priorities. Executives discuss quarterly growth; they should also discuss ecological debt. A fixed one-percent industry payment built into accounting would not cripple profits—it would normalize accountability. Investors would then measure a company’s health by how much it restores, not just how much it earns. Over time, repair becomes reputation.

Financial institutions could amplify this shift. Banks and insurers could refuse credit to companies that ignore industry payments, just as they already do with unpaid taxes or sanctions. Conservation funds could be securitized into tradable bonds, linking habitat recovery to financial performance. None of this requires invention; only intention. The infrastructure exists, the money exists, and the need is immediate. Industry payments could redefine capitalism’s moral code, proving that the same forces that broke the forest can rebuild it—if the cost of destruction finally exceeds the price of silence.

Accountability, Audits, and Results

Every failed conservation plan has shared one flaw: money disappears faster than evidence. Projects launch with banners and end with silence, their budgets dissolved in layers of administration. To make industry payments work, transparency must be absolute. Each contribution should be traceable from boardroom to biosphere, showing what was restored, where, and at what cost. Technology can make this possible. Satellite imagery, blockchain-style ledgers, and open-data portals could let the public see progress in real time. When money moves, the forest should respond.

Auditing must be independent, free from the influence of donors or political allies. Governments are poor guardians of their own failures; NGOs, too dependent on access, often hesitate to name their funders. A global oversight council—built on scientific and legal expertise—could certify every hectare funded by industry payments. Success would be measured in connectivity, population stability, and verified habitat recovery, not in glossy annual reports.

This accountability would rebuild public trust in conservation. People donate less each year not because they care less, but because they no longer believe results. Industry payments can reverse that cynicism. When corporations publish restoration receipts alongside profits, consumers and investors will see conservation as a measurable return. The tiger’s story could finally shift from promises to proof—from a century of excuses to a ledger of repair.

Outro – From Symbol to Settlement

The tiger has lived too long as metaphor. It has been painted, marketed, and celebrated by the same societies that erased its land. The age of admiration must now give way to the age of payment. Donor funding, however sincere, has reached its ceiling; compassion cannot compete with commerce. Only industry payments can match the scale of destruction with the scale of repair. They represent the moral and financial settlement between civilization and the wilderness it consumed.

This is not a new form of charity—it is restitution written into economics. Every brand that borrowed the tiger’s strength must help restore the ground beneath its paws. Every company that mined, logged, or built over its range must pay to rebuild what it displaced. Industry payments turn accountability into architecture, building corridors instead of campaigns, patrols instead of promises.

The world once taxed cigarettes to fund healthcare and carbon to slow the climate crisis. It can now charge industry to rebuild what it destroyed. Governments, investors, and consumers all hold levers powerful enough to enforce it—if they choose to. The tiger’s survival will not depend on speeches or symbolism, but on transactions that finally tell the truth: that nature was never free, only unpaid. When the industries that took start paying back, the balance of the wild might, at last, begin to recover.